Empowering Businesses with Smart, Scalable,

and AI-Driven Solutions.

Welcome to CogentNext : Your Future-Ready IT

Partner

In a world where agility, intelligence, and digital transformation are no longer optional, CogentNext delivers more than just solutions, we bring clarity, efficiency, and future-proof innovation. We specialize in helping businesses thrive through intelligent, practical, and cost-effective IT services powered by the latest advancements in AI and automation.

CogentNext has expertise in ERP / CRM Implementation

We are specialized in implementing Dynamics 365, SAP and Sage ERP/CRM. Are you moving up to ERP or CRM for the first time? Migrating from any other ERP/CRM or upgrading to the latest applications? We can guide you through the process. Are there other systems you need to integrate with your ERP/CRM software? We’ve got you covered. And of course, we’ll be there for the day-to-day challenges with support and maintenance.

Certified Consultants

Our team is comprised of experienced & certified consultants.

24x7 Support

Our consultants are available anytime – day or night – to render assistance.

Development Methodology

We are familiar with both

Agile & Waterfall

methodologies and will adapt

to your preferences.

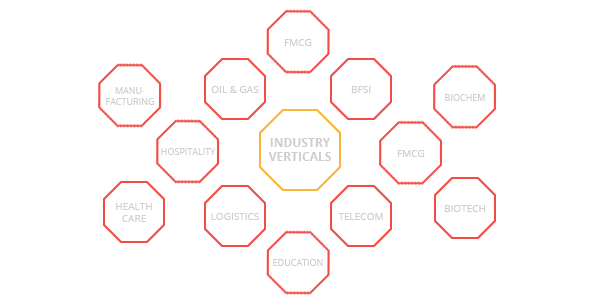

Industry Verticals

We serve numerous Industry

Verticals, partnering with top

ISVs.

Our Services

AI That Works in the Real World

We design systems that sense, learn, adapt, and self-optimize, not just in labs, but across factory floors, boardrooms, and customer journeys.

Microsoft Dynamics 365

Make the leap into the digital age effortlessly by migrating to a true-cloud business management solution. Microsoft Dynamics 365 is a powerful cloud platform that provides ERP and CRM functionality while allowing seamless integration of productivity applications and powerful AI tools.

Copilot

At CogentNext, we help organizations adopt Microsoft Copilot to enhance productivity, integrate AI seamlessly into workflows, and drive real business value.

SAP S/4 HANA

At CogentNext, we recognize the pivotal role that SAP S/4 HANA plays in modernizing and future-proofing your business. Guide through the entire SAP S/4HANA implementation process, from planning and design to go-live and post-implementation support.

Salesforce

We understand the power of Salesforce in building smarter sales, service, and customer engagement experiences.We guide you through the complete Salesforce journey, from strategy and implementation to customization, integration, and ongoing optimization ensuring the platform aligns perfectly with your business goals and delivers measurable results.

Oracle

At CogentNext, we recognize the critical role Oracle solutions play in driving enterprise performance and digital transformation. We guide organizations through the complete Oracle journey, from implementation and upgrades to integration, migration, and ongoing support ensuring secure, scalable, and future-ready systems aligned with business objectives.

Client Testimonials

I have had a positive experience with CogentNext Technologies. Chandra and his team have made me feel fortunate to have them as a part of my solution. They have excelled in their availability and demonstrated true knowledge and well performed project management resulting in positive project outcomes. I highly recommend giving them the opportunity to prove themselves to others.

CogentNext Technologies is our trusted offshore partner. They provide solutions in a quick turnaround time across Microsoft Technologies, be it ERP, CRM, PowerApps, SharePoint or Custom Applications. I recommend them on any given day.

The CogentNext Advantage

- We are expert consultants who are team-players

- We help you define the scope of your project

- We believe in clear communication and transparency

- We use processes and tools that enable project visibility

- We pride ourselves on a quick turnaround time

- We offer quality services at a price that won’t break the bank

Industry Expertise

We serve businesses across many industries such as Finance, Manufacturing, Supply Chain, Retail, Oil & Energy, Utilities, Medical Devices, Real Estate, and Construction. We have partnered with several ISVs who provide industry vertical solutions for Microsoft Dynamics products, helping our clients solve their business challenges.